The PM industry continued its growth track last year, and most indicators

signal a repeat performance in 2015. Metal powder producers, equipment

suppliers, and PM parts makers look ahead to favorable business conditions.

The

metal injection molding (MIM) industry, hot isostatic press (HIP)

business, and specialty PM products markets are gaining as well.

Metal powder shipments modestly increase

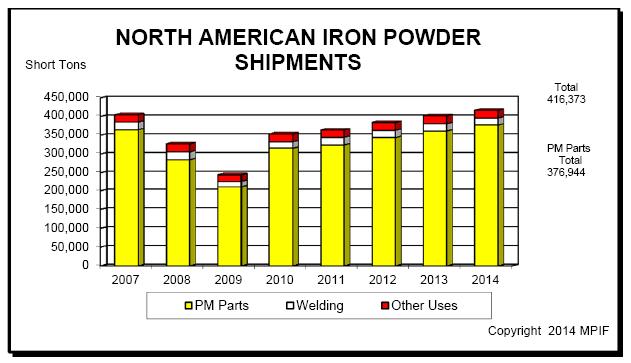

2014 North American iron powder shipments rose a modest 3.6% to 416,373

short tons. The PM sector of this total shipments figure increased by almost

4.4% to 376,944 short tons.

While iron powder shipments topped 400,000 short tons again, we must keep

in perspective the year 2004 when shipments hit a record 473,804 shorts

tons. Estimated stainless steel, copper, aluminum, nickel, molybdenum,

tungsten, and tungsten carbide powder shipments grew in 2014 as follows:

stainless steel 7,850 short tons; copper 17,500 short tons; aluminum 40,000

short tons; nickel 6,000 short tons; molybdenum 1,940 short tons; tungsten

3,600 short tons; tungsten carbide 5,900 short tons. Total estimated metal

powder shipments in 2014 increased by 3.4% to 499,213 short tons - see

below.

|

North

American Metal Powder Shipments |

| |

|

|

|

|

| |

2013 |

|

2014 |

|

| Iron & Steel |

401,738 |

|

416,373 |

|

| Stainless Steel |

7,600 |

(E) |

7,900 |

(E) |

| Copper & Copper Base/Tin* |

16,850 |

(E) |

17,500 |

(E) |

| Aluminum |

37,000 |

(R) |

40,000 |

(E) |

| Molybdenum |

2,050 |

(E) |

1,940 |

(E) |

| Tungsten |

4,200 |

(E) |

3,600 |

(E) |

| Tungsten Carbide |

7,700 |

(E) |

5,900 |

(E) |

| Nickel |

5,775 |

(E) |

6,000 |

(E) |

|

Short tons |

482,913 |

|

499,213 |

|

(E) Estimate

(R) Revised estimate

*PM parts only

PM equipment market overall

PM process equipment builders and tooling makers enjoyed a good year in

2014. PM parts fabricators are ordering new equipment for both capacity

increases and added capability, including more robotics and automation for

both compacting presses and sintering furnaces. There continues to be a

strong trend for larger compacting presses, over 500 tons, and presses with

more motions. Press shipments seem to be stabilizing at about 20 units

annually. In 2013 press shipments rose to 26 presses, with a backlog of 9

presses. In 2014 shipments declined to 19 presses, with a backlog of 11

presses at the end of the year.

Tooling orders remain positive. One major tooling company sees a growing

market for helical gears and a demand for finer and tighter dimensions,

especially on punch faces at +/- 10 microns after milling and polishing.

PM parts makers large and small are upgrading equipment. For example, one

major firm is phasing out older equipment in favor of new CNC equipment and

is considering acoustic blending equipment to achieve more homogeneous

powder mixes. Another smaller, family owned business will spend $3.5 million

on new equipment. These are positive signs reflecting the industry’s health

and boding well for future growth.

Current conditions and business outlook

Emerging from another good year, PM parts companies entered 2015

confident about positive growth indicators on the horizon, even spilling

over into 2017. A recent survey by the Powder Metallurgy Parts Association

reports that two-thirds of the respondents expect business to increase this

year.

Most PM fabricators are doing well, but there are still difficulties

finding qualified employees, especially die setters. The industry must do

more to attract skilled labor and engineering graduates into manufacturing.

MPIF recently participated in career fairs at several universities to

increase engineering students’ awareness of PM. MPIF staff engaged nearly

100 students while providing opportunities for possible employment.

North American iron, copper, and stainless steel powder shipments should

be up again in the three-to-four-percent range. Metal powder companies are

actively pursuing developmental projects to meet market needs and improve

the performance of raw materials through a reduction of lubricants in

binder-treated premixes and the use of a new lubricant for stainless steel

PM materials. A new generation of high-performance PM aluminum materials is

in the wings as well.

A number of key PM parts makers forecast double-digit growth this year in

both automotive and industrial markets. For example, new PM clutch designs

are taking hold in snowmobiles, snow throwers, and all-terrain vehicles.

PM’s high reliability in high-performance clutches is unquestioned, a

welcome sign and an example of the acceptance for PM components that are

used under harsh operating conditions.

Automotive trends

While a positive growth outlook remains in 2015 for PM in a potential

17.3 million car-year market, certain headwinds might diminish the pace of

this growth.

As we reflect on 2004, when iron powder shipments hit a record 473,804

short tons, we note that North American light-vehicle production was 16.2

million units. In 2014, auto builds advanced to 16.8 million units but iron

powder shipments reached only 416,373 short tons. A disconnect appears.

Several explanations suggest themselves. There is a new paradigm for

light-weighting in the automotive industry. Consider the example of the new

2015 Ford F-150 truck, which comes in at a weight of some 700 pounds less

than the comparable 2014 model; light-weight components such as its aluminum

body panels and high-strength steel ladder-frames come straight from

technologies used in the aerospace industry. The trend spawned by

manufacturers’ quest for higher CAFE numbers is toward smaller powertrains,

from eight-, to six-, and to four-cylinder engines, and thus toward fewer

and lighter-weight parts, and away from heavy PM bearing caps and

powder-forged connecting rods. PM, however, is not alone in feeling this

impact: competitive technologies such as castings, wrought forgings, and

machined parts must also pony up to meet rising technological requirements.

MPIF recognizes this light-weighting trend as an opportunity. As such,

MPIF has joined the Lightweight Innovations for Tomorrow (LIFT), an

industry-led, government-funded consortium, to help facilitate technology

transfer into supply-chain companies. LIFT is one of the institutes launched

by the National Network for Manufacturing Innovation. MPIF's move to gain a

voice in this $140+ million dollar program is important for our industry.

Another possible explanation for the disconnect between the increased

auto builds and the failure of powder shipments to rise to previous levels

is that many new engines and transmissions are being designed in Europe and

Asia with less PM content. The number of possible PM applications has

decreased. It is said European auto engineers lean towards higher

performance over cost and toward closer tolerances. For example, in North

America a Class 8 gear is normally acceptable, while European engineers

require Class 9 and 10 gears. Meanwhile, a leading German automatic

transmission supplier has designed an eight-nine speed transmission for a

Detroit 3 auto maker that contains only two PM oil-pump parts.

This trend has had the effect of forcing U.S. parts makers to meet

tighter or “Europeanized” tolerance requirements of less than 10 microns

across the board. Go-to trends for meeting these demands include surface

finish grinding, localized hardening, grinding after heat treating, and

grinding or machining for flatness.

Focusing on distinct PM product sectors with more value-added operations

is another trend involving big-name PM auto parts makers. For one

specialized automotive parts supplier, adding value through extra machining

and other specialized post-processing is enabling the company to book

business into 2020; the company is already in discussions about designs for

the 2021 model year.

PM content in light trucks amounts to between 55 and 60 pounds, with the

average PM content in light vehicles estimated at 45 pounds. This is in

marked contrast with the average European vehicle, which in 2014 contained

an estimated 21 pounds of PM parts.

The metal injection molding (MIM) industry has begun selling into the

automotive market. Automotive engineers are designing more MIM parts, which

points to significant potential growth as MIM becomes more accepted. MIM

parts are being designed for engines, electrical systems, and chassis

hardware.

Trends in metal injection molding, hot isostatic pressing and

additive manufacturing

Despite some bumps in the MIM business road, namely, the saturated

firearms market, 2014 was good to the North American MIM industry. The next

three-to-five years look positive as well. According to a 2014 survey by the

Metal Injection Molding Association (MIMA), the MIM industry is still

ascending its growth-cycle curve at a growth rate well above that of the

GDP. Some have even posited that the industry is still in the steepest

segment of its growth curve. The MIMA survey reported the following primary

end-markets in North America by weight of parts shipped: firearms, 28%;

general industrial, 24%; medical/dental, 19%; automotive, 15%; electronics,

9%; and miscellaneous, 5%.

While the firearms market currently remains somewhat sluggish, it will

most likely stabilize into a more normal growth pattern. However, overall

the MIM industry is set to enjoy a 10% growth rate in 2015, certainly an

enviable position.

The HIP market registered gains last year that should continue into 2015.

The use of PM HIPed products for the oil-and-gas market will increase,

despite declines in oil drilling and fracking. This is mainly due to long

lead times for necessary replacement parts. HIPed PM aerospace parts are

another growing market.

HIP densification of

MIM parts remains a robust growth business, and

there is new interest in HIP from the additive manufacturing (AM) sector.

Additive manufacturing offers an exciting niche business for PM and metal

powder producers. Without a doubt AM presents some very interesting

opportunities as a new PM technology. There are currently three well-known

commercial PM applications: titanium medical implant parts, cobalt-chrome

dental copings, and cobalt-chrome aircraft-engine nozzles made by GE at the

rate of 40,000 annually. RollsRoyce is also testing a prototype front

bearing housing made from a titanium–aluminum alloy for its Trent XWB-97

engines.

A number of powder makers are working on qualifying gas- and

water-atomized powders for AM applications made by laser-based,

electron-beam, and ink-jet processes.

Tungsten and refractory metals

The overall tungsten business faced tough times in the second half of

2014 due to weakening oil prices and mining activity. For example, total

tungsten powder shipments declined by 14.2% in 2014 to an estimated 3,600

short tons. Tungsten carbide shipments dropped 23.3% to an estimated 5,999

short tons. This year will remain rough as well. Oil-and-gas drilling,

important markets for tungsten, could drop by as much as 40 to 60%. The

outlook for mining, another well-established market for tungsten products,

will remain soft. The only bright spots are automotive and aerospace

markets, which unfortunately are not large consumers of tungsten.

MPIF & industry technology support

The MPIF Technical Board is reviewing the importance of reducing

dimensional variability in PM parts and taking a look at steps to improve

dimensional tolerances out of the compacting press. Board members are

gathering information about how process factors such as raw materials,

compacting, sintering, and secondary operations influence dimensional

control. The ultimate goal is to improve the dimensional tolerances of PM

parts by 50%. The board is also studying the development of lean alloys.

The Center for Powder Metallurgy Technology (CPMT), with its 52 industry

members, leads the investigation of strain-controlled fatigue for numerous

PM materials: resonant acoustical processing to enhance powder mixing;

sinter-hardening process improvements for flatness and throughput; die-wall

lubrication for warm compaction tooling; shot peening of gears for improved

performance; and ways to improve tooling to withstand compacting pressures

>60 tsi. CPMT is also providing $32,000 in university scholarships through

various family and corporate grants and sponsored four students to attend

POWDERMET2015 through another family grant.

Individual PM companies continue funding developmental programs aimed at

improved materials and processes to support PM’s growth and future

viability. Equipment makers, for instance, are designing more robust

multi-platen systems in both servo-controlled hydraulic and electrical

compacting presses. Higher-strength PM aluminum alloys are being developed

that provide yield strengths of 45,500 psi, as are high-density stainless

steels >7.4 g/cm3 by single pressing.

Novel R&D programs are being aimed at multiple-scale particulate

composites and combining metallic and ceramic properties, for instance,

joining the abrasion resistance and rigidity of ceramics with the toughness

and electrical conductivity of metals.

In conclusion, resilience and creativity are the hallmarks of today’s PM

industry. Just as it has survived and thrived in the face of previous

economic trials, these qualities will help insure that the industry will

continue to grow in the face of challenges yet to come.

This story is reprinted from material from MPIF, with editorial

changes made by Materials Today. The views expressed in this article do not

necessarily represent those of Elsevier.